Smart Financial Tips for Fall

As the days get shorter and temperatures begin to cool, fall is the perfect time to take a fresh look at your finances. With the holidays approaching and the end of the year in sight, it’s important to prepare for upcoming expenses, protect your home, and start planning for tax season. Here are some practical financial tips to help you make the most of your money this fall.

Prepare for Holiday Spending

The holidays are a time for celebration, but they can also strain your finances if you are unprepared. Start planning now to avoid stress later by:

- Setting a Holiday Budget: Review your income and expenses to determine how much you can spend on gifts, decorations, and festivities. Make a list of people you plan to buy for and set spending limits to keep everything within budget.

- Open a Holiday Savings Account: If you haven’t already, consider setting up a holiday savings account, like a Christmas Club account, to set aside funds specifically for holiday shopping. Contributing regularly can help cover costs when the season arrives.

- Shop Early: Take advantage of fall sales to spread holiday purchases over time. This can help you avoid last-minute spending and potentially higher prices closer to the holidays.

- Track Your Expenses: Use financial apps or mobile banking tools to monitor spending. This can help you stay within your budget and adjust as needed.

Fall Home Maintenance

As we head into the colder months, fall is the time to make sure your home is in good shape to prevent costly repairs and keep utility bills under control:

- Perform a Heating System Check: Schedule a tune-up for your furnace or heating system. Regular maintenance not only keeps your system running efficiently but can also prevent expensive repairs down the line.

- Seal Windows and Doors: Drafty windows and doors can lead to higher energy bills. Check for gaps and apply weather stripping or caulk to keep the cold out and reduce heating costs.

- Clean Out Gutters: Falling leaves can quickly clog your gutters, leading to water damage. Clean them out this fall to protect your home and avoid expensive repairs later.

- Consider Refinancing Your Mortgage: With interest rates often fluctuating, fall could be a good time to refinance your mortgage and lower your monthly payments. Consult with your financial institution to see if this option fits your situation.

Get Organized for Tax Season

It may seem early to think about taxes, but fall is an ideal time to start getting organized, especially if you want to minimize stress when tax season arrives.

- Review Your Withholdings: Check your most recent pay stub to ensure that your tax withholdings are correct. If you’ve had a significant change in income or life circumstances this year, now is the time to make adjustments.

- Maximize Your Tax Deductions: Take advantage of any end-of-year deductions, such as charitable contributions or contributions to retirement accounts like a 401(k) or IRA. These can help reduce your taxable income.

- Organize Your Financial Documents: Start gathering receipts, invoices, and other important documents to make tax filing smoother. If you’re self-employed, keeping track of expenses now can help reduce the year-end scramble.

- Use Your Flexible Spending Account (FSA): If you have a health-related FSA, check your balance and plan to use those funds before the year ends. Many FSA plans have a “use-it-or-lose-it” policy, so don’t let that money go to waste.

Revisit Your Budget

Fall is also a good time to review your overall budget and financial goals as the year wraps up. Make adjustments to ensure you’re on track for the future:

- Review Your Spending Habits: Take a look at your recent bank statements to identify areas where you may be overspending. Fall is a great time to curb unnecessary expenses and save for year-end goals.

- Boost Your Emergency Fund: As we head into a season of potential unexpected expenses, like higher heating costs or holiday travel, make sure your emergency fund is stocked. Aim to have at least 3-6 months of living expenses saved.

- Check Your Credit Score: Fall is a great time to check in on your credit score and make sure everything is accurate. If you need to improve it, start working on paying down debt or addressing any errors in your report.

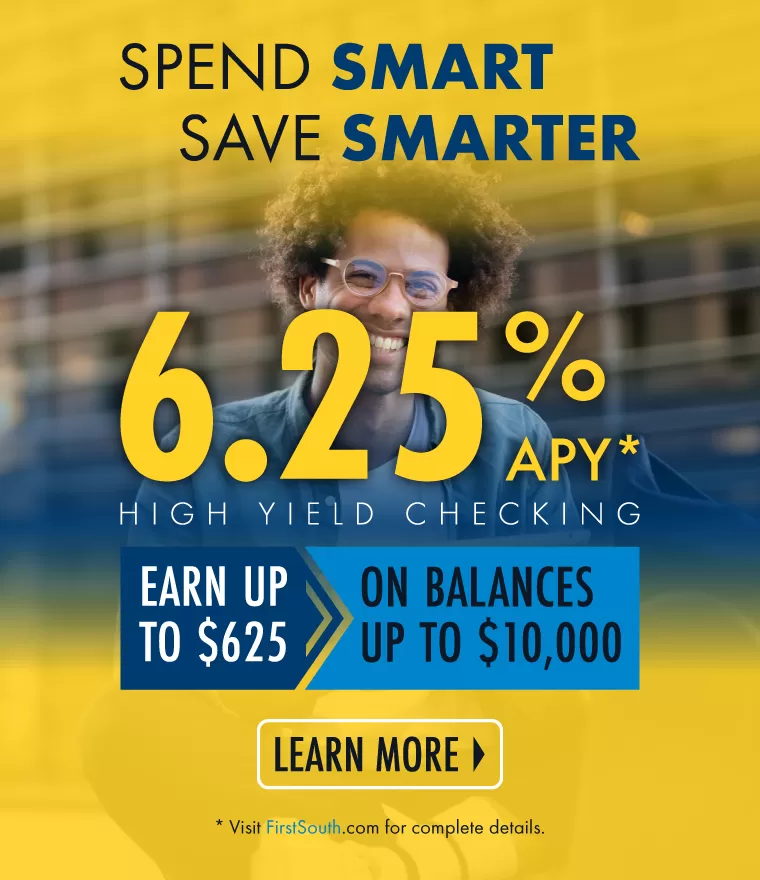

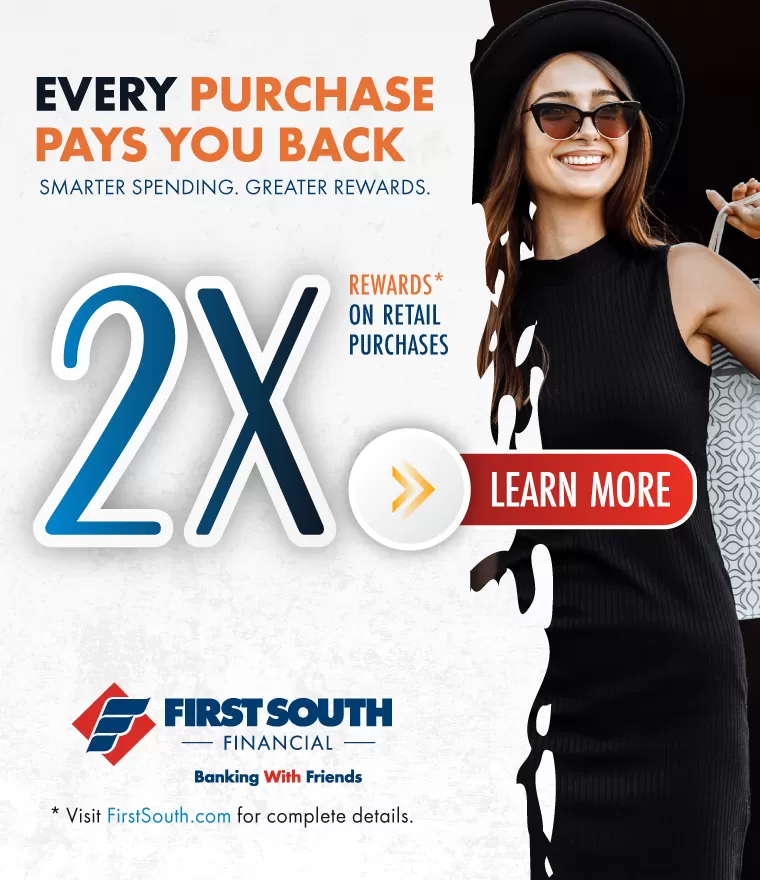

Stay on Track This Fall with First South Financial

At First South, we’re here to help you reach your financial goals this fall and beyond. Whether you are preparing for the holidays, making home improvements, or planning for tax season, we offer a range of products and services to keep your finances in order. Visit us today to learn more about how we can help you stay ahead this season.

« Return to "Blog" Go to main navigation