How Our CD Rates Compare to the National Average

In an unpredictable economic climate, it’s more important than ever to make smart financial decisions—especially when it comes to your savings. One of the safest, most dependable ways to grow your money is through a Certificate of Deposit (CD). However, not all CD rates are created equal. We’ve put together this in-depth comparison to show you how First South Financial’s CD rates stack against national averages—and why now may be the best time to invest.

What is a CD and Why Should You Consider One?

A Certificate of Deposit (CD) is a type of savings account that offers a fixed interest rate over a specified term. Unlike traditional savings accounts, CDs reward you for committing your funds for a set period—typically ranging from a few months to several years. In return, you receive a higher interest rate, making CDs a smart choice for individuals who want low-risk, stable returns.

Want to dive deeper into how CDs work, what to look for in a rate, and when it’s the right time to invest? Listen to our latest podcast episode where our financial experts break down everything you need about Certificates of Deposit—from the basics to smart strategies for maximizing your returns.

Whether you're new to CDs or looking for expert tips to make your savings go further, this episode is packed with helpful insights.

First South Financial’s CD Rates (As of April 2025)

At First South Financial, we offer a variety of CD options to fit your financial goals. Here’s a snapshot of our most current offerings:

Standard CD Rates:

| Term | APY |

|---|---|

| 3 Months | 3.78% |

| 6 Months | 3.57% |

| 12 Months | 3.30% |

| 18 Months | 3.30% |

| 24 Months | 3.14% |

| 30 Months | 3.14% |

| 36 Months | 3.13% |

| 48 Months | 3.14% |

Special Promotions:

| Term | Product | APY | Min. Deposit |

|---|---|---|---|

| 4 Months | CD | 4.25% | $5,000 |

| 7 Months | IRA CD | 4.50% | $5,000 |

Rates subject to change. Early withdrawal penalties may apply.

National Average CD Rates (April 2025)

To help put our rates into perspective, here’s a look at the current national averages for CDs, according to Bankrate:

| Term | National Average APY |

|---|---|

| 3 Months | 1.30% |

| 6 Months | 1.79% |

| 12 Months | 1.86% |

| 24 Months | 1.66% |

| 36 Months | 1.57% |

| 60 Months | 1.58% |

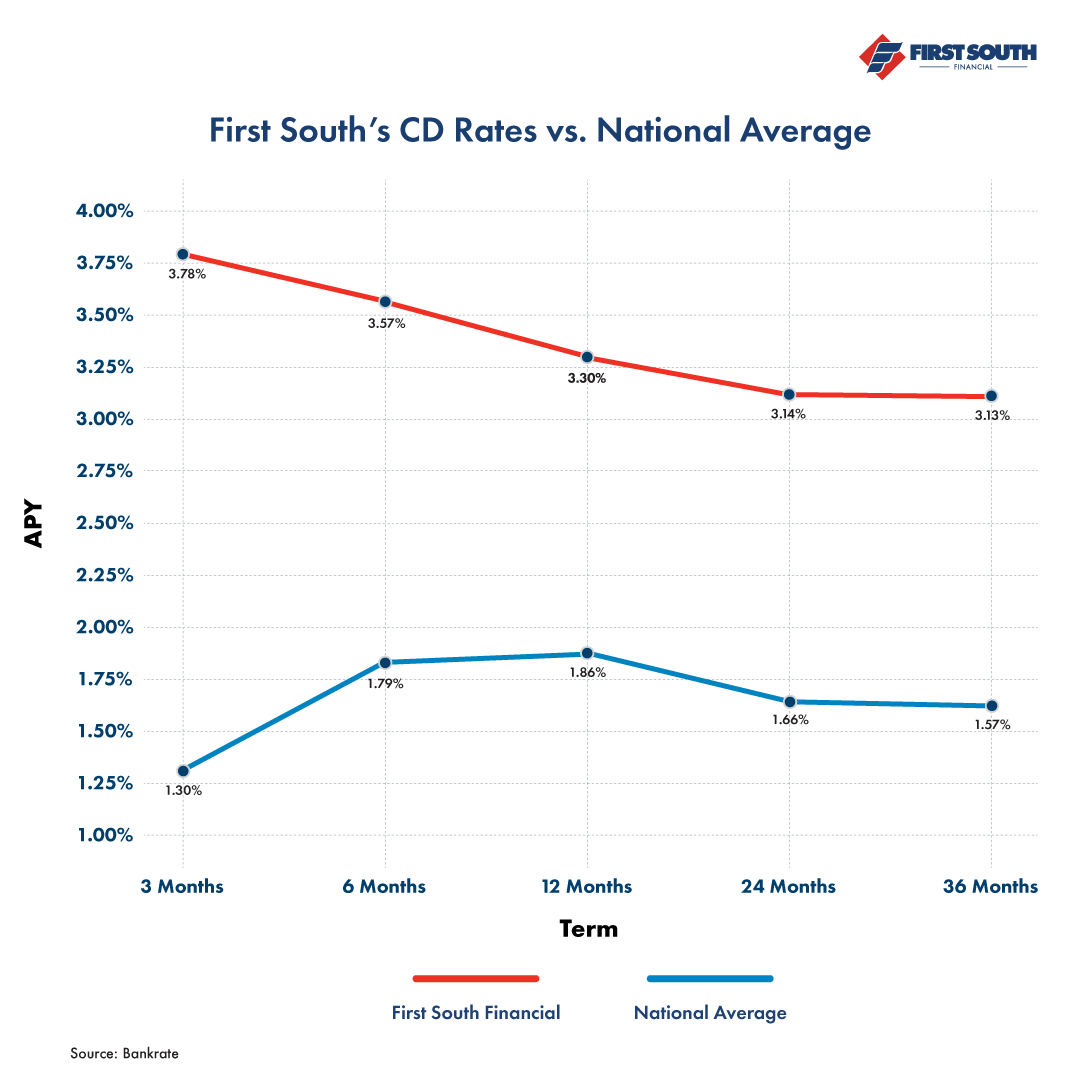

Side-by-Side Comparison: First South vs. National Average

Let’s take a closer look at how First South Financial outperforms the competition.

3-Month CD

First South: 3.78% APY

National Average: 1.30% APY

Your return is almost 3x higher than the national average.

6-Month CD

First South: 3.57% APY

National Average: 1.79% APY

You earn about 100% more with us.

1-Year CD

First South: 3.30% APY

National Average: 1.86% APY

You earn nearly 80% more with us.

3-Year CD

First South: 3.13% APY

National Average: 1.57% APY

Your return more than doubles compared to the national average.

Why Our CD Rates Are So Competitive

At First South Financial, we’re proud to be a not-for-profit credit union. That means we return earnings to our members in the form of better rates, lower fees, and more personalized service. When it comes to CDs, this philosophy helps us offer:

- Higher-than-average yields

- Flexible terms for every savings goal

- Guaranteed best rates—we’ll beat any local bank or credit union

- Low minimum deposits to get started

- Insured deposits up to $250,000 for peace of mind

Who Should Consider a CD Right Now?

CDs are a smart choice for a wide range of savers, including:

- Conservative investors seeking low-risk returns

- Retirees looking to lock in predictable income

- Young professionals building an emergency or long-term savings fund

- Anyone who wants to earn more than a traditional savings account can offer

With inflation still a concern and market volatility ongoing, locking in a high CD rate today can be a strategic way to protect your purchasing power and grow your savings.

Take Advantage of Higher CD Rates While They Last

Interest rates are cyclical. What’s high today could drop tomorrow. That’s why acting now can make a significant difference in your long-term savings strategy.

At First South Financial, we’re proud to offer some of the most competitive CD rates in the country—rates that beat national averages by a wide margin. Whether you're saving for a big goal, building your retirement nest egg, or just want a better return on your hard-earned money, our CDs offer a smart, secure path forward.

Ready to Start Saving Smarter?

Explore our current CD options and apply online in minutes. Visit our CD rates page here, or stop by your nearest First South Financial branch.

Grow your savings—with confidence. With First South.

« Return to "Friends & Finances"