Debt Consolidation: Reduce Payments, Gain Control

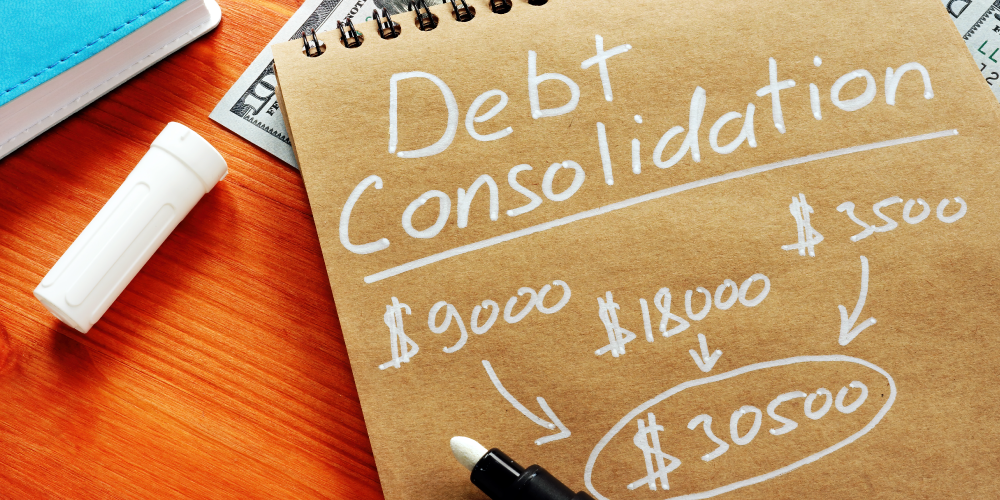

Debt consolidation is a financial strategy that combines multiple debts into a single, manageable monthly payment. The goal of consolidating debt is to simplify your finances, lower your interest rates, and make it easier to pay off your debts. Whether you're struggling with high-interest credit cards, medical bills, or multiple loans, debt consolidation can help you regain control and work towards becoming debt-free.

In this article, we'll explain the basics of debt consolidation and the options available through First South Financial to help you reduce your debt more effectively.

What is Debt Consolidation?

Debt consolidation involves taking out a loan or utilizing a financial product to pay off several debts. By consolidating your debts, you can combine multiple high-interest balances into a single payment with a potentially lower interest rate. This can make your debt repayment process more straightforward and less stressful.

When consolidating debt, it’s important to understand the following benefits:

- Lower Interest Rates: Consolidating high-interest debt (like credit cards) with a lower-rate loan can reduce the total amount of interest you pay.

- Simplified Payments: Instead of managing multiple due dates and payment amounts, you’ll have one monthly payment to track.

- Potential for Lower Monthly Payments: If the consolidation loan has a lower interest rate or longer repayment term, it may reduce your monthly payments.

However, debt consolidation does not erase your debt; it simply changes the way you manage and pay it. It's crucial to continue making regular payments to avoid falling back into debt.

Debt Consolidation Options with First South Financial

At First South Financial, we offer several debt consolidation options tailored to your needs, helping you simplify your payments and reduce your debt. Here’s a look at the available options:

Personal Loans

One of the most popular ways to consolidate debt is through a personal loan. A personal loan from First South Financial allows you to consolidate multiple high-interest debts into one loan with a fixed interest rate and monthly payment. Personal loans typically offer lower interest rates compared to credit cards, making it easier to pay off debt faster.

- How It Works: You apply for a loan for the amount of debt you want to consolidate. If approved, the loan funds are used to pay off your existing debts, leaving you with one monthly payment at a potentially lower interest rate.

- Benefits: A fixed rate gives you predictable payments, and you can choose a term that works for your budget.

Balance Transfer Credit Cards

A balance transfer credit card allows you to move high-interest debt from one or more credit cards to a new card with a 0% APR for an introductory period (usually 12–18 months). This offers the chance to pay off your debt without incurring interest charges during the introductory period.

- How It Works: Transfer the balances of your higher-interest credit cards to a credit union credit card offering a 0% APR for a specified time. During the introductory period, you make payments toward reducing your balance without paying any interest.

- Benefits: Save money on interest and pay off your debt more quickly. Be sure to pay off the balance before the introductory period ends to avoid a spike in the interest rate.

Home Equity Loans and Lines of Credit (HELOCs)

If you own a home and have built up equity, you may be able to tap into that equity to consolidate debt. A home equity loan or line of credit (HELOC) allows you to borrow against the value of your home to pay off existing debts. These options typically offer lower interest rates than unsecured loans, making them a good choice for those with significant debt.

- How It Works: You can use a home equity loan or HELOC to pay off credit card debt, medical bills, or other loans. These loans are secured by your home, so they usually come with lower interest rates.

- Benefits: Lower interest rates, possible tax deductions on interest (consult with a tax advisor), and larger loan amounts due to the equity in your home.

Debt Management Plans (DMPs)

A Debt Management Plan (DMP) is a service offered through credit counseling agencies that can help you consolidate your debt into one monthly payment. These plans allow you to work with a counselor to negotiate lower interest rates and payments with your creditors. While First South Financial does not directly provide DMPs, we can refer you to trusted, certified credit counseling agencies to set up a plan.

- How It Works: You work with a counselor to consolidate your unsecured debts into a single payment. The counselor will communicate with your creditors to secure more favorable terms.

- Benefits: A DMP helps you make one payment to the counseling agency, which then pays your creditors. It’s an option for those who need professional assistance managing their debt.

Cash-out Refinancing

If you have a mortgage, cash-out refinancing allows you to refinance your home and borrow additional funds to pay off other debts. This option can be beneficial if you have substantial equity in your home and need to consolidate a large amount of debt.

- How It Works: You refinance your mortgage for a higher amount than you currently owe, and the extra funds are used to pay off other debts.

- Benefits: A lower interest rate compared to credit card debt, and the interest may be tax-deductible (consult a tax professional).

Next Steps for Debt Consolidation with First South Financial

If you're ready to explore debt consolidation options with First South Financial, consider the following steps:

- Evaluate Your Debt: Review your existing debts to understand the total amount you owe, interest rates, and monthly payments.

- Choose the Best Option: Depending on the amount of debt and your financial situation, choose the option that best meets your needs.

- Apply for a Loan or Credit: If you opt for a personal loan, balance transfer credit card, or home equity loan, apply with First South Financial to begin the process.

- Stick to Your Plan: After consolidating your debt, make sure to continue making regular payments and avoid accumulating new debt.

Conclusion

Debt consolidation is an excellent strategy to regain control over your finances. Whether you choose a personal loan, balance transfer credit card, home equity loan, or another solution, First South Financial offers a variety of options to help you simplify your payments and lower your interest rates. If you're struggling with multiple debts, consider debt consolidation as a way to reduce financial stress and work toward becoming debt-free.

« Return to "Friends & Finances"