Building Credit: A Step-by-Step Guide

Building a strong credit history is crucial for financial success, especially for young adults just starting. A good credit score can open doors to various opportunities, including better interest rates on loans, credit cards, and apartments. While it may seem daunting, building credit is achievable with a little effort and discipline.

Why is Building Credit Important?

A good credit score can have a significant impact on your financial life. Here are some of the benefits:

- Lower Interest Rates: A good credit score can help you secure lower interest rates on loans, such as mortgages, car loans, and student loans. This can save you thousands of dollars over the life of the loan.

- Easier Credit Approval: Lenders are more likely to approve your applications for credit cards and loans when you have a good credit score. This means you can access credit as needed, such as for emergencies or unexpected expenses.

- Better Rental Prospects: Landlords often check your credit score before approving a rental application. A good credit score can increase your chances of getting approved for your desired apartment, making it easier to find a place to live.

- Peace of Mind: Knowing you have a strong credit history can provide peace of mind and financial security. It allows you to make larger purchases and investments with confidence, knowing you can qualify for favorable terms.

How to Build Credit from Scratch

Building credit may seem overwhelming at first, but following these steps can help you establish a solid credit history:

Get a Credit Card

One of the most effective ways to build credit is to use a credit card responsibly. Start with a secured credit card, which requires a security deposit to open. This deposit acts as your credit limit and minimizes risk for the lender. Make sure to use your card for regular purchases, such as groceries or gas, and pay your balance in full each month to avoid interest charges. This habit shows lenders you can manage credit responsibly.

Make On-Time Payments

Your payment history is the most significant factor in determining your credit score, accounting for about 35%. Always make your payments on time, whether for your credit card, student loans, or other debts. Setting up automatic payments can help ensure you never miss a due date. Even a single late payment can negatively impact your credit score, so prioritize this aspect of credit management.

Keep Your Credit Utilization Low

Credit utilization refers to the amount of credit you're using compared to your total credit limit. Aim to keep your utilization rate below 30%. For example, if your total credit limit is $1,000, try to keep your balance below $300. Keeping your credit utilization low shows lenders that you’re not overly reliant on credit, which can positively impact your score.

Limit New Credit Applications

While it might be tempting to apply for multiple credit cards or loans to boost your credit options, too many inquiries for new credit can negatively impact your credit score. Each time you apply for credit, a hard inquiry is made on your report, which can lower your score temporarily. Only apply for new credit when necessary and try to space out your applications over time.

Monitor Your Credit Report

Review your credit report regularly to ensure it's accurate and free of errors. You can get a free copy of your credit report from each of the three major credit bureaus (Experian, Equifax, and TransUnion) once a year at AnnualCreditReport.com. Checking your report allows you to catch any discrepancies early and dispute them, which can help maintain a higher credit score.

Additional Tips

- Become an Authorized User: Ask a family member or friend with good credit to add you as an authorized user on their credit card. This can help build your credit history, especially if you have a long history of on-time payments. Their positive payment history will be reflected on your credit report, enhancing your score.

- Consider a Credit Builder Loan: Some credit unions offer credit builder loans, which can help you establish a positive credit history. In this arrangement, you deposit money into a savings account, and the loan is reported to the credit bureaus as a loan with on-time payments. This not only helps your credit but also allows you to save.

- Diversify Your Credit Types: Once you've established a solid credit history with one or two credit products, consider diversifying your credit mix by applying for a personal loan or an unsecured credit card. Having different types of credit can improve your credit score.

- Be Patient: Building credit takes time and patience. Don’t get discouraged if you don’t see immediate results. Keep making responsible financial decisions, and your credit score will improve over time.

Conclusion

Building credit from scratch is an essential financial milestone for young adults. You can establish a solid credit foundation by understanding the importance of credit, following these actionable steps, and practicing responsible financial habits. Remember, your credit journey is just beginning, and the steps you take today will pave the way for greater financial opportunities in the future.

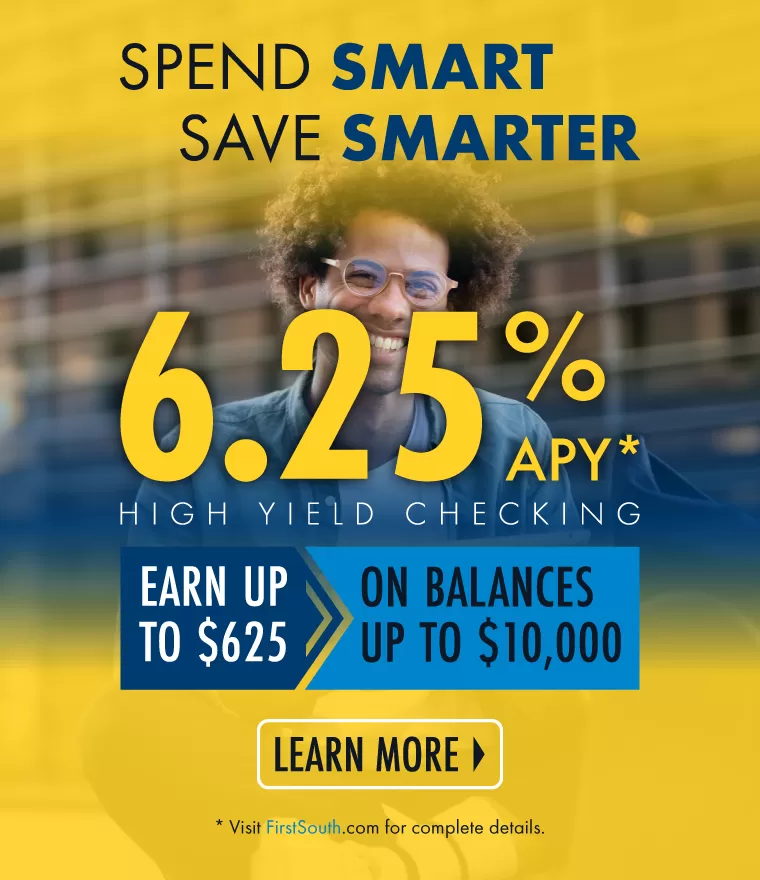

First South Financial Credit Union is here to support your financial journey. We offer a variety of credit cards and financial education resources to help you build and maintain a healthy credit score. Visit our website or contact us today to learn more about how we can help you achieve your financial goals!

« Return to "Blog"